You may have heard of a tracker mortgage – but what is it and how does it work?

Trackers can seem complicated and work in a very different way to fixed rate mortgages, which are more common.

So, in this guide, we’ll be explaining what a tracker is as well as comparing the pros and cons against fixed rate deals.

How tracker mortgages work

Tracker mortgages fall under the variable rate mortgage category.

This means the interest rate you pay when you have a tracker mortgage can change, meaning your repayments can go up or down.

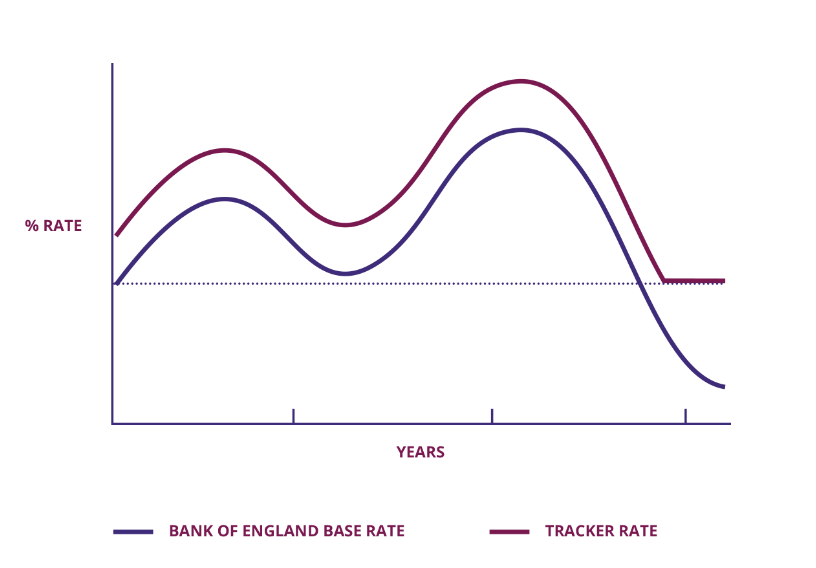

Tracker mortgages follow the Bank of England’s base interest rate and the interest rate you pay is usually the base rate plus a certain percentage.

An example would be a tracker mortgage offered at the base rate plus 1.5%.

If the base rate was 3%, your mortgage interest rate would be 4.5%.

But if the base rate were to go up, perhaps by 0.25%, your mortgage interest rate would also rise by 0.25%.

And if the base rate were to fall, your interest rate would drop by the same amount.

Other types of variable rate mortgage

As well as trackers, the other main types of variable rate mortgage available are:

1. Discounted rate mortgages

The interest rate you pay with a discounted mortgage is your lender’s Standard Variable Rate (SVR) with a discount attached.

For example, a mortgage offered with a discount of 1% with a lender’s whose SVR was 5% would see you pay 4% interest.

Because your lender’s SVR is set by them and can change at any time, your monthly repayments can go up or down.

2. Standard Variable Rate (SVR) mortgages

Most people end up on a lender’s Standard Variable Rate (SVR) when their existing mortgage deal expires.

A lender’s SVR can change at any time and will often be a higher rate than any previous deal.

However, SVR’s usually have no early repayment charges (ERCs) attached, meaning you may be able to remortgage on to a cheaper deal without having to pay a penalty.

Tracker mortgages and early repayment charges

Tracker mortgages usually have cheaper early repayment charges (ERCs) attached, while many trackers have no ERCs at all.

These can mean switching deals or moving home is easier and less expensive than being on a fixed rate mortgage, which may come with higher ERCs for leaving the deal early.

How long do tracker mortgages last?

The majority of tracker mortgages last for an initial period of two-to-five years.

Generally speaking, the longer your tracker deal, the higher the initial interest rate you’ll pay.

The longer you’re tied into a tracker deal, the more likely you are to experience either increases or decreases in your monthly payments due to rises or falls in the Bank of England base rate.

Tracker mortgage collars

Some tracker mortgages come with a ‘collar’ or ‘floor’.

This is the minimum interest rate you’ll pay even if the Bank base rate falls.

An example would be a collar of 2% on a tracker of 1% above the base rate.

This would mean you’ll always pay at least 2% in interest, even if the base rate were to fall below 1%.

The same deal without the collar would see your interest rate drop below 2% if the base rate fell to below 1%.

Tracker mortgage caps

Tracker mortgage caps are the opposite to collars and set the maximum rate of interest you’d pay even if the Bank rate rises considerably.

Caps are less common than collars, while a tracker with a cap in place would generally start at a higher interest rate than one without.

What happens at the end of a tracker mortgage?

When your tracker mortgage deal comes to an end, your lender will usually move you on to their Standard Variable Rate (SVR).

This could see your mortgage repayments go up, so is often a good time to consider remortgaging on to a cheaper deal, either with your current lender or a new one.

Are tracker mortgages or fixed rate mortgages better?

Tracker mortgages and fixed rate mortgages come with a number of key differences.

Which one is better for you will depend on your circumstances and whether you favour flexibility or security.

Tracker mortgages…

- Usually start at a cheaper interest rate than fixed rate mortgages

- Follow the Bank base rate, meaning your repayments can go up or down

- Often come with no early repayment charges (ERCs), making them a flexible option if you need to move or change deals

Fixed rate mortgages…

- Usually come with higher introductory rates than trackers

- Offer the security of fixed payments regardless of the Bank rate rising or falling

- Usually come with higher early repayment charges (ERCs) than trackers

It’s estimated as many as 75% of UK mortgages are fixed rate deals.

But trackers remain popular with certain buyers, particularly when interest rates are high with the potential to fall.

At the time of writing, Moneyfacts reported there were 1,471 fixed rate mortgages on the market, compared with 236 variable rate deals which include trackers.